New Launch vs. Resale Condos: Freehold and Leasehold Trends in Singapore’s Property Market

New launch vs resale condos is a key decision for property buyers in Singapore’s dynamic market. From lifestyle needs and budgets to investment goals, understanding the differences between these options is essential. While new launch condos offer sleek modernity and future appreciation potential, resale condos provide immediate occupancy and established neighborhoods. Add the choice between freehold and leasehold properties, and it becomes even more important to evaluate your priorities carefully.

From tenure types (freehold vs leasehold) to pricing structures and investment potential, understanding the differences can help you make a choice that aligns with your goals. Whether you’re eyeing developments in Clementi, Orchard, or Jurong, this guide explores the key factors to consider when choosing between these options.

Why Choose New Launch Condos?

New launch condos are often the top choice for buyers seeking contemporary living spaces with potential for capital appreciation. These developments feature state-of-the-art designs, cutting-edge amenities, and layouts tailored to modern lifestyles.

One key advantage of new launch properties is the Progressive Payment Scheme, which allows buyers to stagger payments over the construction period. This reduces immediate financial strain and makes ownership more accessible for many. Additionally, new launches located in growing areas, such as District 5’s Elta Condo, often see substantial value appreciation by the time they are completed, making them a preferred choice for investors.

However, there are trade-offs. Buyers must wait for the project’s completion, which could take several years. Prices for new launches can also be higher than comparable resale units in the same area.

Why Choose Resale Condos?

For those who prefer immediate availability, resale condos are a practical option. These properties are move-in ready, making them ideal for families or professionals who need housing without the wait. Resale condos are often located in mature neighborhoods like Clementi, Tiong Bahru, Marine Parade, or Bukit Panjang.

offering established communities, easy access to amenities, and excellent connectivity.

Another significant advantage is transparency. Buyers can inspect the actual unit and surrounding environment before committing, ensuring they make an informed decision. While resale units may require renovation to modernize their interiors, they often come at a more affordable price compared to new launches.

Freehold vs Leasehold Properties: What’s the Difference?

Freehold condos offer ownership that lasts indefinitely, making them a long-term asset. These properties are especially appealing to families or individuals looking to preserve generational wealth. While more expensive, these properties tend to retain their value over time, particularly in prime areas like Holland Village or Tanglin.

However, their premium pricing and limited availability often make them less accessible.

On the other hand, leasehold condos, typically with a tenure of 99 years, are more affordable and widely available. They are popular among younger buyers and investors seeking short- to mid-term returns. While leasehold properties may depreciate as their tenure runs out, their lower price point and strong rental demand often offset this drawback.

Current Investment Trends in Singapore

The Singapore property market continues to evolve, with emerging trends shaping buyer preferences. New launch condos, particularly those located near MRT stations or within integrated developments, remain highly desirable for their potential to appreciate in value.

Buyers are drawn to modern amenities and the higher potential for capital appreciation offered by new developments, especially in growth areas like Punggol and Bidadari. Projects like Elta Condo in Clementi attract buyers for their modern amenities, proximity to schools, and excellent connectivity.

Meanwhile, resale condos in mature neighborhoods like Toa Payoh, Queenstown, Pasir Ris, Clementi and Bukit Timah retain their appeal for families and professionals seeking established communities. These properties are especially attractive for their proximity to schools, transport hubs, and lifestyle amenities.

Additionally, mixed-use developments that combine residential, retail, and transport options are gaining popularity in areas like Jurong East and Woodlands, where the demand for convenience is high. Buyers are increasingly prioritizing convenience, making such properties a key focus for both homeowners and investors.

New Launch vs. Resale Condominiums

Over the past decade, new launch condominiums have commanded increasing premiums over resale units across all regions:

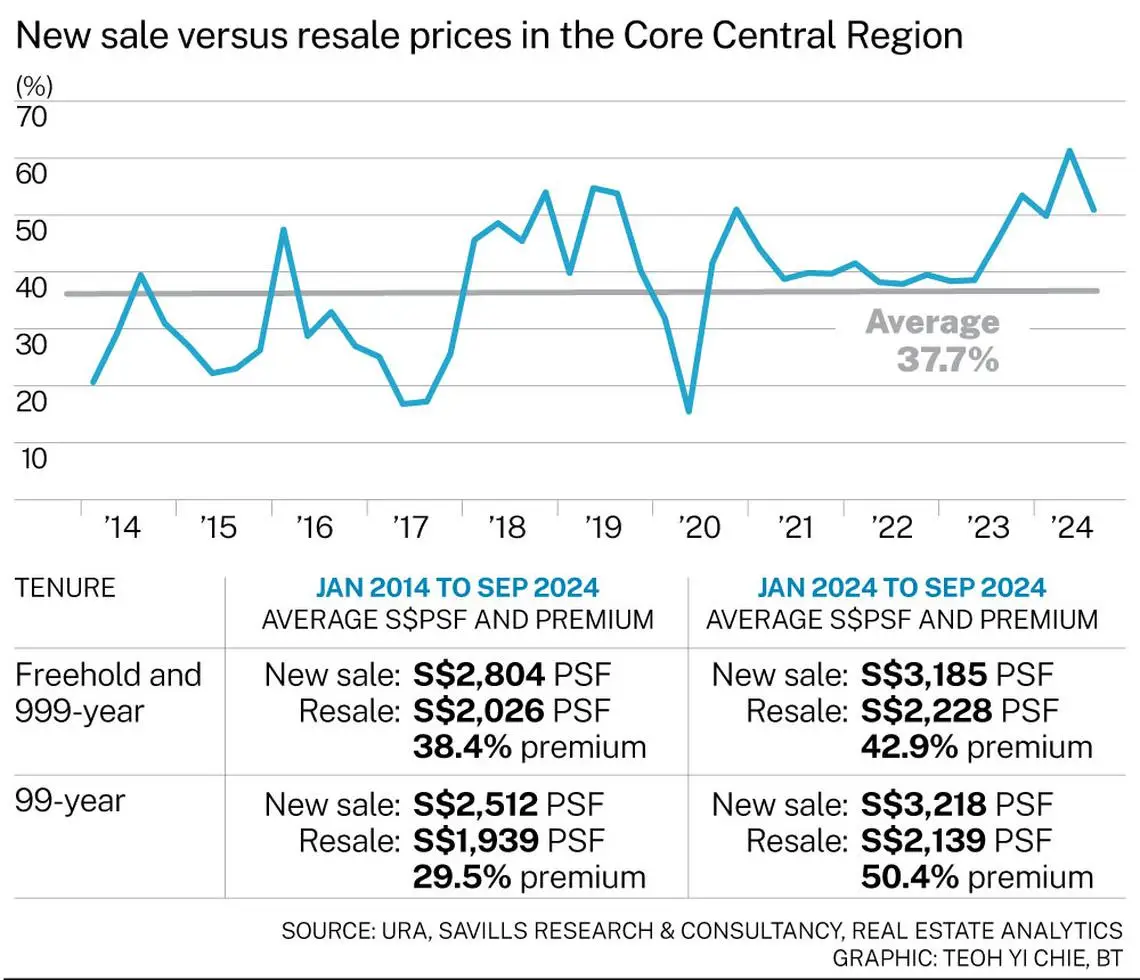

•Core Central Region (CCR): The premium for new sales over resale units peaked at 61.3% in Q2 2024, settling at 50.9% in Q3 2024, significantly above the 10-year average of 37.7%.

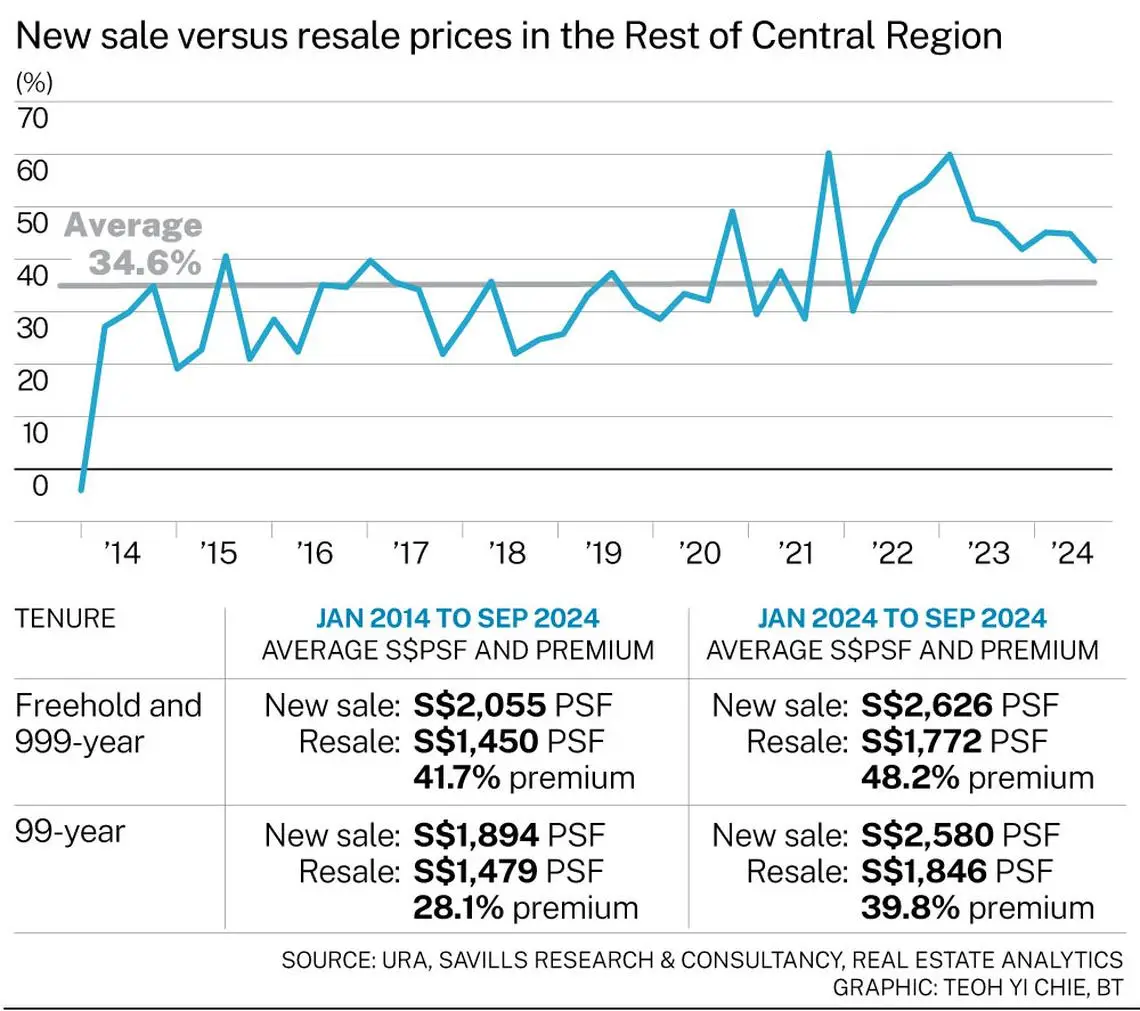

•Rest of Central Region (RCR): As of Q3 2024, the premium stood at 39.7%, close to the long-term average of 34.6%.

•Outside Central Region (OCR): The premium was 44.9% in Q3 2024, down from a peak of 63.1% in Q3 2022, but still above the historical average.

These premiums are largely attributed to rising land and construction costs, particularly during the 2021-2022 period when COVID-19 disruptions led to sharp increases.

Freehold vs. Leasehold Properties

The choice between freehold and leasehold properties also influences buyer decisions:

•Leasehold Properties: In the CCR, the premium for new sale leasehold units averaged 50.4% in the first three quarters of 2024, compared to a long-term average of 29.5%.

•Freehold Properties: In the RCR, the premium for new freehold units was 48.2% in the same period, slightly above the long-term average of 41.7%.

These trends suggest that while new launch properties command higher prices, the gap between freehold and leasehold properties varies by region and is influenced by factors such as location, demand, and buyer preferences.

Market Outlook

As Singapore’s population ages, there may be resistance to rising private property prices based solely on population growth. Instead, increasing HDB resale prices could drive demand from upgraders. However, measuring upgrading demand is challenging due to limited statistics.

Recent successful launches, such as Norwood Grand in Woodlands, indicate that new projects in areas with rising HDB resale prices can attract significant upgrader interest.

Conclusion

Ultimately, the decision between a new launch condo and a resale condo, or between freehold and leasehold properties, depends on your individual needs. If you’re seeking cutting-edge designs, flexible payment plans, and future value, new launches are a great choice. For those who value immediate availability, mature locations, and established communities, resale condos might be the better option.

No matter your preference, Singapore’s property market offers a wealth of opportunities, from the dynamic Jurong Lake District to the serene enclaves of Upper Thomson. Explore your options and make an informed decision that suits your lifestyle and investment goals.

When deciding between new launch and resale condominiums, and between freehold and leasehold properties, buyers should consider current market trends, regional differences, and personal circumstances. Staying informed about these factors will aid in making sound property investment decisions in Singapore’s evolving real estate landscape.

Note: This article is a rewritten summary based on information from The Business Times. For detailed insights, refer to the original article.